Real-Time Requests

What is Real-Time Requests

Recurring invoicing is essential for businesses

that rely on scheduled payments—whether it's for subscriptions,

memberships, utilities, or professional services. Traditional

payment methods like ACH or credit cards often introduce delays,

settlement issues, and security concerns.

Real-Time Requests powered by FedNow®

and RTP® (Real-Time Payments) revolutionize this process by

enabling instant, recurring payment collection. Through

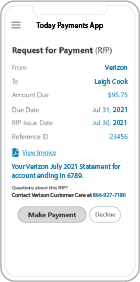

Request for Payment (RfP) using ISO 20022 messaging, a

Payee can digitally request funds from a Payer, who can

instantly approve and send money—all while using aliases or monikers

to keep sensitive banking data secure.

At

TodayPayments.com, we provide an alias-based, real-time

invoicing platform built for recurring static or variable payments

across all industries.

To approve an RfP (Request for Payment) FedNow Real-Time Request, you would typically need to follow these steps:

Receive the payment request: The first step is to receive the payment request from the sender (Payee). The request would typically include details such as the amount due, the payment due date, and the sender's contact information.

Review the payment request: Once you receive (Payer) the payment request, you would review it to ensure that the details are accurate and that you agree with the amount due. You may also want to verify that the sender is a trusted party.

Approve the payment request: If you agree

(Payer) with the details of the payment request, you would typically approve it using the appropriate interface or API provided by your bank. This would initiate the real-time payment, which would be processed through FedNow.

Monitor the payment status: After approving the payment request, you

(Payer) would typically monitor its status to ensure that the payment is processed correctly. This can be done through your bank's account or using an API provided by your bank.

Receive confirmation of payment: Once the payment is processed, you should receive

(Payee & Payer) confirmation that the payment has been made. This could include a receipt or other documentation that confirms the payment details.

It's important to note that the specific steps and requirements for approving RfP FedNow Real-Time Requests may vary depending on your bank's specific policies and procedures. Additionally, you should always take appropriate security measures to ensure that you are only approving payment requests from trusted parties.

Implementing Real-Time Requests for

Payments (RfP) for Business Billers (Payees)

To integrate Real-Time Requests for

Payments (RfP) for a business biller using SecureQBPlugin.com with

QuickBooks Online (QBO), follow these detailed steps:

Step-by-Step Guide

- Set Up QuickBooks Online (QBO)

- Ensure your QuickBooks Online

account is set up with the appropriate subscription level

to support advanced features and integrations.

- Make sure your QBO account is

properly configured for invoicing and payment processing.

- Ensure your QuickBooks Online

account is set up with the appropriate subscription level

to support advanced features and integrations.

- Register with

SecureQBPlugin.com

- Create an account on

SecureQBPlugin.com.

- Complete the onboarding

process, including linking your QuickBooks Online account

with SecureQBPlugin.com.

- Ensure your account is

configured to support real-time payment processing through

RTP and FedNow.

- Create an account on

SecureQBPlugin.com.

- Enable Real-Time Payment

Networks

- Verify that SecureQBPlugin.com

is set up to handle RTP (Real-Time Payments by The

Clearing House) and FedNow (Federal Reserve).

- Ensure your bank or payment

processor supports these networks for seamless

integration.

- Verify that SecureQBPlugin.com

is set up to handle RTP (Real-Time Payments by The

Clearing House) and FedNow (Federal Reserve).

- Configure ISO 20022 Messaging

- Ensure that SecureQBPlugin.com

supports ISO 20022, the global standard for financial

messaging.

- Configure QBO to handle ISO

20022 formatted messages for sending and receiving RfPs.

- Ensure that SecureQBPlugin.com

supports ISO 20022, the global standard for financial

messaging.

- Create Digital Invoices in

QuickBooks Online

- Use QBO to generate digital

invoices, including necessary details such as amount, due

date, and itemized charges.

- Include options for one-time

or recurring payments as needed for your business.

- Use QBO to generate digital

invoices, including necessary details such as amount, due

date, and itemized charges.

- Generate and Send RfPs via

SecureQBPlugin.com

- When creating an invoice in

QBO, use SecureQBPlugin.com to generate an RfP.

- SecureQBPlugin.com will format

the RfP in ISO 20022 and send it to the payer through

their bank’s dashboard or a link on the payee’s payment

page.

- When creating an invoice in

QBO, use SecureQBPlugin.com to generate an RfP.

- Payer Receives and Approves RfP

- The payer receives an RfP

notification on their bank’s dashboard or the payment

page.

- The payer reviews the details

of the RfP and approves the payment.

- The payer receives an RfP

notification on their bank’s dashboard or the payment

page.

- Instant Payment Processing

- Once the payer approves the

RfP, the payment is processed instantly through RTP or

FedNow.

- The business biller receives

the funds in real-time, with immediate settlement.

- Once the payer approves the

RfP, the payment is processed instantly through RTP or

FedNow.

- Payment Confirmation and

Reconciliation

- Both the payer and the payee

receive confirmation of the payment.

- QBO, through

SecureQBPlugin.com, updates the invoice status to 'Paid'

and reconciles the payment in real-time.

- Both the payer and the payee

receive confirmation of the payment.

- Automate Recurring Payments (if

applicable)

- For recurring payments, set up

a recurring invoice schedule in QBO.

- SecureQBPlugin.com

automatically generates and sends RfPs at the designated

intervals.

- Payments are processed and

reconciled in real-time, reducing manual intervention.

- For recurring payments, set up

a recurring invoice schedule in QBO.

Example Workflow

One-Time Payment

- Invoice Creation:

- Generate a one-time invoice in

QuickBooks Online.

- Generate a one-time invoice in

QuickBooks Online.

- RfP Generation:

- Use SecureQBPlugin.com to

generate an RfP formatted in ISO 20022.

- Use SecureQBPlugin.com to

generate an RfP formatted in ISO 20022.

- RfP Sending:

- Send the RfP to the payer’s

bank dashboard or the payee’s payment page.

- Send the RfP to the payer’s

bank dashboard or the payee’s payment page.

- Payer Approval:

- The payer reviews and approves

the RfP.

- The payer reviews and approves

the RfP.

- Instant Payment:

- Payment is processed

instantly, and the invoice status in QuickBooks is updated

to 'Paid'.

- Payment is processed

instantly, and the invoice status in QuickBooks is updated

to 'Paid'.

- Reconciliation:

- Payment details are

automatically reconciled in QuickBooks.

- Payment details are

automatically reconciled in QuickBooks.

Recurring Payment

- Recurring Invoice Setup:

- Set up a recurring invoice

schedule in QuickBooks Online.

- Set up a recurring invoice

schedule in QuickBooks Online.

- Automatic RfP Generation:

- SecureQBPlugin.com

automatically generates RfPs at each billing cycle.

- SecureQBPlugin.com

automatically generates RfPs at each billing cycle.

- RfP Sending:

- RfPs are sent to the payer’s

bank dashboard or payment page at regular intervals.

- RfPs are sent to the payer’s

bank dashboard or payment page at regular intervals.

- Payer Approval:

- The payer reviews and approves

each RfP.

- The payer reviews and approves

each RfP.

- Instant Payment:

- Payments are processed

instantly each time, and invoice statuses are updated in

QuickBooks.

- Payments are processed

instantly each time, and invoice statuses are updated in

QuickBooks.

- Reconciliation:

- Each payment is reconciled in

QuickBooks with detailed remittance information.

- Each payment is reconciled in

QuickBooks with detailed remittance information.

Benefits of Real-Time RfP

Integration

- Efficiency:

- Reduces delays in payment

processing by enabling instant payments.

- Reduces delays in payment

processing by enabling instant payments.

- Improved Cash Flow:

- Enhances cash flow management

with quicker payment receipts.

- Enhances cash flow management

with quicker payment receipts.

- Security:

- Provides robust security with

ISO 20022 messaging and real-time payment networks.

- Provides robust security with

ISO 20022 messaging and real-time payment networks.

- Convenience:

- Simplifies the payment process

for both payers and payees.

- Simplifies the payment process

for both payers and payees.

- Automation:

- Automates the invoicing and

payment process for recurring transactions, reducing

manual tasks.

- Automates the invoicing and

payment process for recurring transactions, reducing

manual tasks.

By integrating Real-Time Request for

Payment (RfP) using SecureQBPlugin.com with QuickBooks Online,

businesses can streamline their invoicing and payment processes,

improve cash flow, and enhance overall efficiency. This

integration ensures that payments are processed in real-time,

providing a seamless experience for both payers and payees.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

Software Integration: Integrate your Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

Today Payments

...continues to meet the challenge of our clients by offering cost effective "good funds", real-time, instant, credit card, ACH and e-invoice payment processing services into the electronic payment solutions banking system. Electronic banking includes the transfer of funds between companies (B2B) and/or (B2C) consumer accounts for collection and payments. Today Payments Gateway Merchant Services gives your company choices in the method of faster payments that you can accept from your customers.

Our payment processing platform is designed for simplicity and ease-of-use.

SecureQB Cloud payment processing integration for QuickBooks ® give you the Best transaction detail information, real-time, with matching error-proof through QuickBooks.

Process with the Real-Time Requests Professionals

- Automation of Accounts Receivable Collection with Real-Time Settlement & Deposit

- Automation of Accounts Payable Payments with Real-Time Settlement & Deposit

- One-Time & Recurring Real-Time Credits with Settlement & Deposit

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Real-Time Requests payment processing